Fundamental Transformations

Tim McMahon identifies an important under-current in the progressive shape-shifting of words and their meanings. Our post-modern era is littered with the constant barrage of changing ideas about our words and therefore, our history.

“Marriage” doesn’t mean what it used to, nor does “gender”, or “inflation.” In particular McMahon notes the confusion with words used to describe economic reality. For example, debt is now a good thing, although entirely contrary to old adage about “the borrower becoming the lender’s slave.”

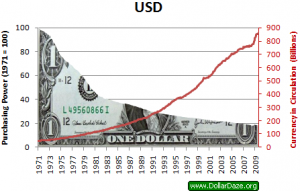

McMahon writes, “between 1983 and 2000 the definition of inflation appears to have shifted from the cause to the result.”

McMahon writes, “between 1983 and 2000 the definition of inflation appears to have shifted from the cause to the result.”

According to the 1983 Webster’s New Universal Unabridged Dictionary the definition of “inflation” is:

“An increase in the amount of currency in circulation…”

Yet in 2000, The American Heritage® Dictionary of the English Language, Fourth Edition, defines “inflation” as:

“A persistent increase in the level of consumer prices or a persistent decline in the purchasing power of money…”

This confusion is easy to understand. Most of us routinely describe things in terms of results instead of causes. Like, “Un-wed pregnancies are on the rise.” While this may be true it avoids the causes. Therefore, half-witted solutions may rise to the surface quicker because the counter-balancing evidence is not presented.

Without properly identifying the true causes of inflation, or the true results of inflation, the statists remain in control. The professional deceivers who are supposed to be representing our true interests are actually defrauding us.

Inflation

Inflation is really a transfer of wealth from creditors to debtors. It appears as higher prices but it is really a loss of buying power. Where did your buying power go? Did you really misplace it? Or, was it stolen?

The US Federal government has the largest net-debt on planet earth. More than twice as much debt as the 2nd place nation – Japan. No nation owns more debt than our nation.

This means that the government, as a debtor, gets to make payments with currency that is worth less than when the debt was assumed. Inflation dismisses government debt so that the full value of what is borrowed is never recouped. Ultimately, this is an enormous transfer of your wealth, as a taxpayer, to the bureaucracies in Washington.

Inflation is both dishonest and deliberate.

The political elites in Washington, DC have no desire to stop this chicanery. Reducing the federal budget would mean less power and control for them, while furthering free market independence for us. Politicians do not want to reduce their own ability to lavish rewards on their business cronies and acquaintances.

The creation of new money allows innumerable bureaucrats to grow their respective organizations while throttling businesses, private property owners, and families with extensive, costly and unjustified regulatory actions.

This is power. This is what politicians, both Republicans and Democrats, want to keep.

Our unbalanced budget is the main mechanism that the FED uses to justify creating more money. The Government could tell the current citizens that they are going to increase taxes to provide necessary services. But, this is political suicide, because the tax-paying public would howl like banshees.

Only this slight-of-hand can allow these deceivers to place that burden on citizens of future generations. Will your children grow up to express their gratitude for the debt on their shoulders? Do you really think those who are not yet born will accept the burdens we willing place on their backs?

No, they won’t.

You and I are responsible

You and I are accountable.

You and I must act with prudence or America will not survive.

When more is spent than can be raised by taxes, the government makes up the difference with fiat money. This occurs because our Representatives in the Republican-controlled House are unwilling to cut Pres. Obama’s gargantuan spending plans. (House passes Obama’s $1.1 trillion budget.)

Instead they choose monetary debasement by increasing the money supply. It is a dishonest scheme where government force is used to take wealth from people and spend it. Central banks throughout the world have become modern day versions of legalized counterfeiters.

In today’s podcast discusses an article from David Stockman’s Contra Corner, Greece and Euroland’s Crumbling McMansion of Debt, by Charles Hugh Smith.

Please listen and enjoy while you learn…

So very well said. It is frightening to see a world which has moved away from an economy of tangibles to one of intangibles. Not so very long ago if our nation launched (with brisk debate of course) a tremendously important expedition like the Lewis and Clark exploration of the west it flatly could not be accomplished on credit. Real money had to be moved around and reallocated or the team could not depart. At that time tangible goals could only be pursued with tangible assets. Some checks so to speak were written along the way, but they were covered by trust in the casher and their cold hard cash. Yes, there was a time when people and governments had to have real tangible money in order to buy what they needed. As the ability to leverage debt evolved though, one no longer had to struggle to save sufficient real money to buy a house which might be valued at many times their annual salary, they just (after approval) had to sign a loan contract and make monthly payments. That system was based upon the realistic and prudent expectation of both lender and buyers. As two income households started leveraging bigger nicer houses and those things beyond what they simply needed the economy started burgeoning and that was good indeed. Yet here we are today when the underlying rules of tangible economics are seemingly forgotten. No longer are the forces of rational expectations, the fearful respect of overarching debt and the critical need for balanced profits beings translated into solid assets – or the vital jobs which arise from making something of worth from raw materials (creating and adding value). Now, for the most part currency, market shares and real estate etc. are no longer treasured for what they are reasonably worth, but instead they are valued on the intangible basis of perception and feelings. To many, even the staggering weight of government debt seems unimportant if not totally irrelevant. It goes without saying that feelings by themselves invariably tend to swing wildly outside the boundary of reason and reality. Thus when a national or global economy finds itself based largely on intangible emotion; there is reason to be concerned that sooner or later there will be a depression of sorts. Actually the societal, moral, environmental, foody and economic suicidal tendencies we see wildly growing in the world today does have the propensity to make a person feel a bit pessimistically concerned if not rightfully disheartened. I supposed one should not be surprised though when the blind and self deceptive and destructive essence of the human condition has been more or less summed up for us in Matthew 13:13 “…Because seeing they see not, and hearing they hear not, and neither do they understand.” As the captain said while he looked at a huge hole in his ship, “I don’t know precisely what coming next, but I am sure it won’t be all that good. Sineek

The previous ideas are well known. What is not known is the financial disaster, the ticking time bomb, regarding local and state pensions costs. This is because it is not reported by national,state, and local media. Nor, by govt. agencies. That is lying by omission. Today, states have 4 TRILLION dollar in unfunded liabilities. These have never been funded pensions, but are placed on future generations: they are on credit; not real dollars. The whole thing is a giant credit bubble. This was set in motion by John Kennedy when he ran for senator promising federal workers these outlandish pensions: he was elected. Something for nothing still has a broad appeal. Call it greed, selfishness, stupidity, etc. it has to be exposed in order to stop it. I have trying to do this for 15 years. We need better marketing. That is what is wrong. I have some ideas. please respond. Fred Starkey 3842 Hayden Bridge Road Springfield, Oregon 97477

Fred, my apologies for not noticing your note. Please email me with you thoughts dennis@dirtroadeconomist.com I’ll enjoy reading your ideas because it sounds like you’re on the right track. How do market prudence, when our culture says, “that’s boring… Let’s Party!”

Mr. Walden from Hood River appears to be visibly agitated with a private sector that keeps demanding, “Enough with the Public Sector (SRS) welfare!”…and yet, the wobbling plates keep spinning. https://www.youtube.com/watch?v=rXitBxpNKvE