Oregon State Legislature sent this bulletin Wednesday, January 30, 2019 by devadmin

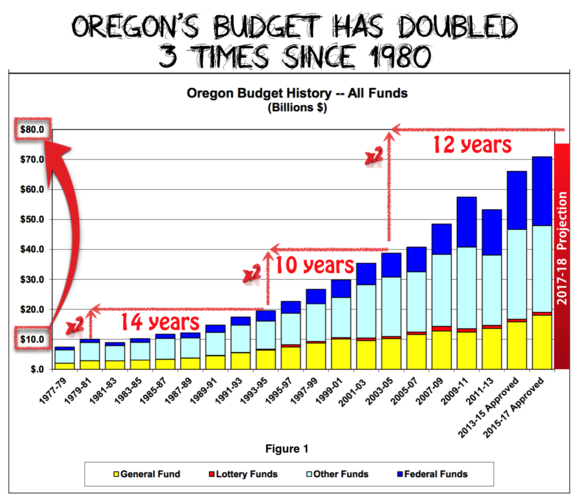

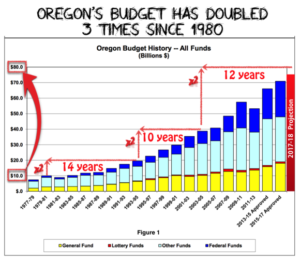

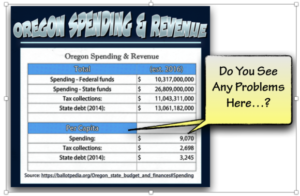

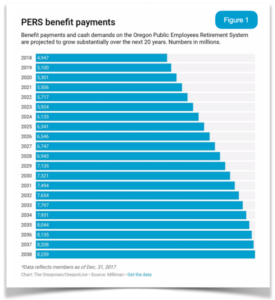

Last year, Oregon’s Public Employee Retirement System (PERS) extracted roughly $1,400,000,000 ($1.4 billion) in contributions from tax-payers to fund state employees’ pension benefit programs. Over that same period, it paid out $4,700,000,000 ($4.7 billion) in pension benefits to state employees. (See Figure 1.)

Any bookie would recognize a lame horse when they saw it. Namely, PERS had a negative cash flow of $3,300,000,000 ($3.3 billion) during that one-year period and the problem is getting worse.

One would think that a negative operating cash flow of this size, shape and demographic velocity would be seen as a bad omen and everyone would be worried. Yet, no serious reforms can even get traction because everyone is bogged down in language about fairness, safety, inclusion and the need to fulfill promises.

Yet when the trestle bridge gets overloaded because everyone wants off the island at the same time, a lot of people will get hurt.

In this environment it’s hard to project the details lying dormant within the blue-sky assumptions undergirding the PERS system. Even more difficult to grasp is the catastrophic potential that these assumptions mask when market events slowdown causing liabilities to balloon.

In a recent Oregonian article, Allen Alley, a past gubernatorial candidate, inventor and technology investor, suggested that policymakers should start looking at the actual cash flowing out of the system. Alley calculates, that the 4.1 million tax-payers will owe $225,000,000,000. ($225B) for state employee retirement benefits over the next three decades.

Although PERS, as an issue, is always present, it is treated like a heavy punching bag in the corner at the gym–it gets ignored. Unfortunately, our governor’s top two policy goals aren’t related to PERS. They are revenue, staff, and policy issues that grow government and eventually worsen the tax-payer burden while ignoring the economic reality barreling straight at all municipal, county and state governments across the US.

All public sector retirement plans, and most private sector plans, carry unheard of levels of unfunded actuarial accrued liabilities (UAAL). The public pension crisis has been intensifying for quite some time and state governments are unwilling to go to the bag. This is mainly because governors, senators, representatives, county commissioners and city council members get elected on “present day promises,” not “future unintended consequences.”

For many years, annual returns for employees and their benefit accounts were pegged at 8-percent per annum. These promises were made during a brief period when that rate seemed reasonable but would have long-term unintended consequences. Additionally, this return-on-investment (ROI) was guaranteed by tax-payer pickups during years with lower returns.

The folly of this strategy becomes clear in a Bloomberg article, which looked at long-term returns (50-year periods) and noted average returns, for pension-fund-like portfolios, are well below 6-percent and have only generated returns of 7 percent or greater twice since 1871. (See Figure 2.)

The article continues, saying the problem is worse today for two primary reasons: 1) “Cumulative returns are lower than the averages;” 2) “An extended period of bad returns cannot be made up even with astronomical returns later.”

Bloomberg goes on to explain that the compounding of these return projections is the real fly in our collective soup bowl. According to Bloomberg most funds can never keep up with their actuarial demands following a market downturn. The capital lost and the compounding interest required on the remaining capital is too great. This would be true, even if the pension was already fully funded, which Oregon PERS is not. Following market retractions, “there is no chance existing assets are enough to pay already-contracted liabilities.”

The proverbial spilled-soup comes when one realizes that once the base value of assets starts to decline there is no scooping it back up. The shrinking asset base can’t keep up with the demand pressure from the actuarially accrued increases in liabilities. Additionally, as payouts create greater shortfalls, the overall asset base shrinks even more, further inhibiting the fund’s ability to ever get ahead of the curve.

Bloomberg goes so far as to say, “Worrying about the next five decades is pointless, because there’s also no chance the current system will survive long enough to discover what the next 50-year average returns will be.”

This is a truly dire situation created by more than 50 years of unrelenting government growth sanctioned by elected representatives. It is unconscionable to not address this inadequacy when there are thousands of folks who will be negatively affected by this tragedy if we fail to act.

Alley claims that his calculation of $225B doesn’t even account for any new employees coming into the system but focuses only on existing employees. “As a CEO of a company, you think about cash,” he said. “What’s the check I have to write and where’s that money going to come from?”

Rest assured, there are no worries in that quarter… the political majority can easily figure out how to use our slowly deteriorating social contract and government’s misused power of coercion to their own advantage. As the noted 19th-century philosopher Pierre-Joseph Proudhon outlined, the tax-payers can expect to be:

fleeced, exploited, monopolized, squeezed, hoaxed, drilled, registered, counted, taxed, stamped, measured, numbered, assessed, licensed, authorized, admonished, prevented, forbidden, reformed, corrected, punished regulated, enrolled, indoctrinated, preached at, controlled, checked, estimated, valued, censured, repressed, fined, harassed, judged, condemned, or deported…

Without a momentous shift toward slowing the growth in government our PERS dilemma will only worsen. Additionally, significant and serious modifications to new employee standing is the only mechanism that can begin to stem the potential economic tsunami resulting from a market downturn. Without these changes Oregonians will face far more turmoil than the political elites ever imagined.

Remember, if we don’t stand for rural Oregon values and common sense – No one will!

Dennis Linthicum

Oregon State Senate 28